|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

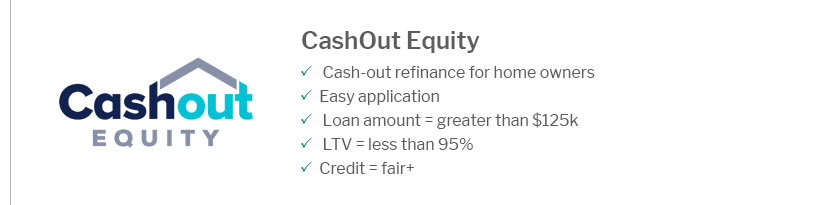

Refinance Second Home Mortgage: Steps and ConsiderationsUnderstanding the BasicsRefinancing a second home mortgage can be a strategic financial move, but it's essential to understand the basics before diving in. A second home mortgage is typically used for vacation homes or investment properties, and refinancing involves replacing the existing loan with a new one, often to secure better terms or rates. Reasons to RefinanceLower Interest RatesOne of the primary reasons homeowners refinance is to take advantage of lower interest rates. This can reduce monthly payments and save significant amounts over the loan's life. Change Loan TermsAltering the loan terms, such as switching from a 30-year to a 15-year mortgage, can help pay off the loan quicker and save on interest payments. Access Home EquityRefinancing can also provide access to the home's equity, which can be used for renovations, debt consolidation, or other financial needs. Steps to Refinance

Challenges and ConsiderationsRefinancing a second home mortgage may present challenges, such as stricter lender requirements or higher interest rates compared to primary residences. Always weigh potential savings against costs like closing fees and prepayment penalties. Frequently Asked Questions

https://themortgagereports.com/41146/how-to-use-a-cash-out-refinance-to-buy-another-home

Equity from your existing home can be a great way to buy a vacation home or investment property. Many homeowners cash out their home equity ... https://www.bankrate.com/mortgages/second-home-refinancing/

Refinancing a second home or investment property can help you secure a lower interest rate, shorten your loan term, reduce your monthly payments ... https://www.rocketmortgage.com/learn/refinance-second-home

With a rate-and-term refinance for a second home, you can leverage up to 90% of the property value, meaning you'll need 10% equity. However, ...

|

|---|